change in net working capital dcf

Working capital is usually defined to be the difference between current assets and current liabilities. Changes in working capital -2223.

Kroger Stock Time To Take Some Profit Nyse Kr Seeking Alpha

Lets say you expect business to kick up over the next year.

. Change in Net Working Capital Net Working Capital for Current Period Net Working Capital for Previous Period. We will back out cash and investments in marketable securities from current assets. First Im assuming you know WC Current Assets - Current Liab.

File with a little more detail. Year 2 Working Capital 180m 190m 10m. In this video I cover the different ratios tha.

The change in working capital which includes accounts receivable accounts payable and inventory must be calculated and added or subtracted depending on their cash impact. You dont think youll have time to. When you use the lower number for changes in working capital and then compute the net present value the result is consistent with the true theoretical number.

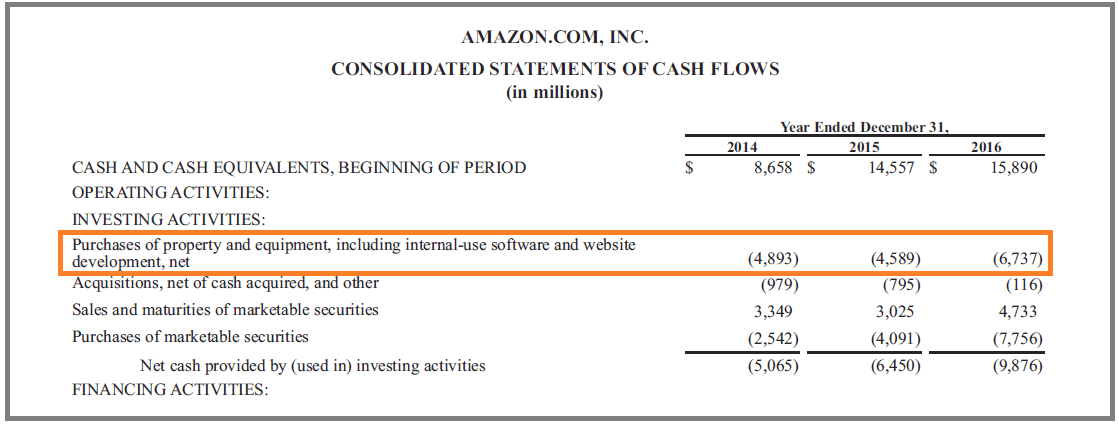

For most companies you analyze by using the change in working capital in this way the FCF calculation and owner earnings calculation is similar as it was for Amazon and Microsoft. Wc was 20m in 2009 wc was 25m in 2010 therefore there is a 5m CHANGE in wc. The screenshots below illustrate the same type.

How do you project changes in net working capital NWC when building your DCF and calculating free cash flow. Accounts Payable 45m 65m. Working capital increases.

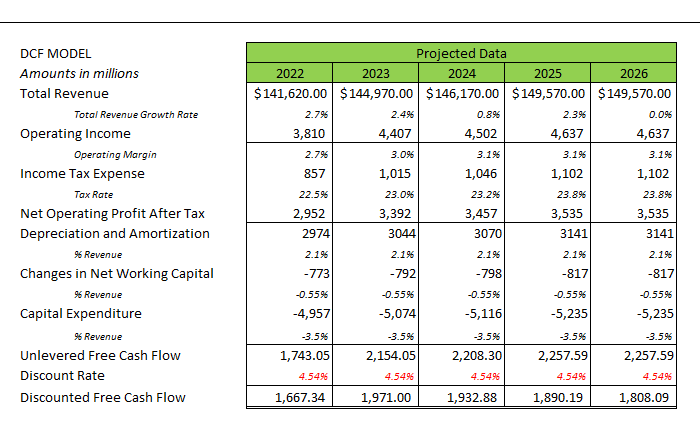

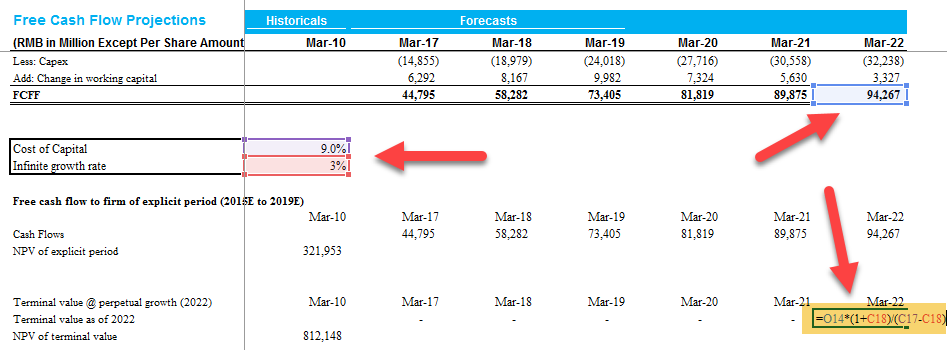

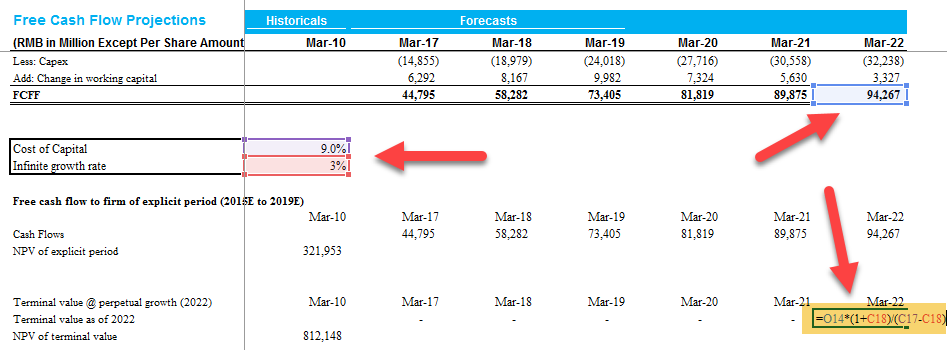

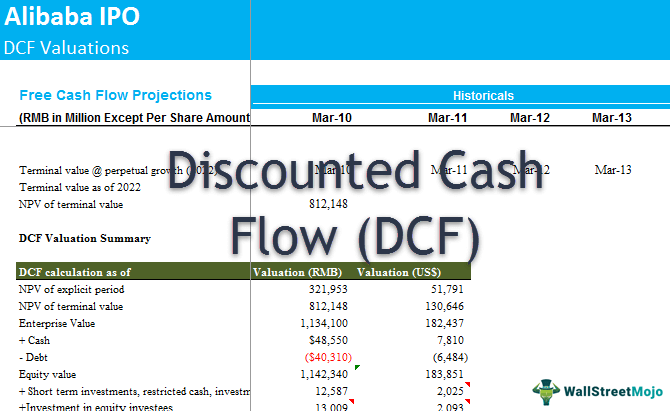

In 3-statement models and other. That final year includes adjustments to NWC DA and CapEx if you are using the Gordon Growth method since you are using unlevered FCF. One is to use the change in non-cash working capital from the year 307 million and to grow that change at the same rate as earnings are expected to grow in the future.

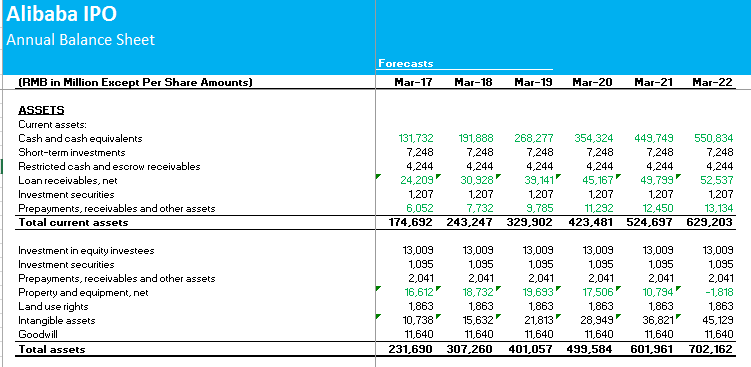

The Working Capital is the measure of cash needs of the company for day-to-day business activities it is the short term financing needs of the expanding business operations. Working capital in valuation. Working capital in valuation.

You used to keep 100 cups on your stand before running across the street to get more. May 20 2011 - 244pm. Certified Investment Banking Professional - Director.

The Change in Working Capital gives you an idea of how much a companys cash flow will differ from its Net Income ie after-tax profits and companies with more power to collect cash quickly from customers and delay payments to suppliers tend to have more positive Change in Working Capital figures. Year 1 Working Capital 140m 145m 5m. Owner Earnings 8903 14577 5129 13312 2223 13084.

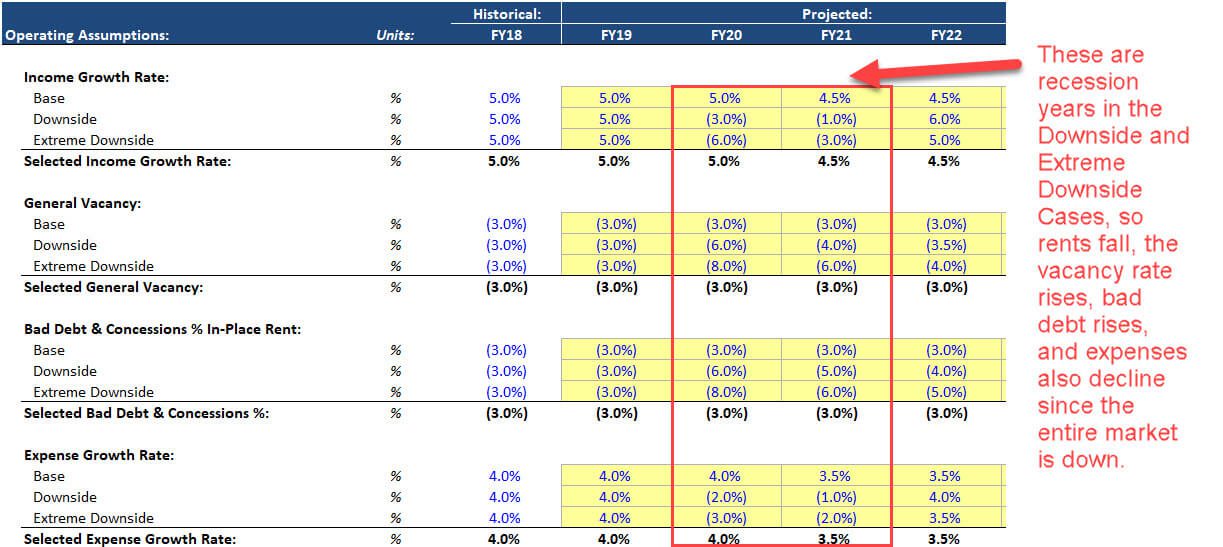

Terminal value is a simple calculation using the last years FCF Gordon Growth or EBITDA multiple method. In this video I cover the different ratios tha. Under ordinary operating conditions many if not most companies have positive working capital current assets exceed current liabilities so forecasted increases in revenues require additional working capital investments and free cash flow is reduced all else held constant.

However we will modify that definition when we measure working capital for valuation purposes. In Year 1 the working capital is equal to negative 5m whereas the working capital in Year 2 is negative 10 as shown by the equations below. Second seems like you may be referring to the CHANGE in working cap.

The negative working capital values stem from increases in. You need to buy an new ice cooler capital expense to stock more ice. This is whats important in the context youre speaking of.

It is calculated as current assets excluding cash minus current liabilities excluding debt. The net working capital metric is a measure of liquidity that helps determine whether a company can pay off its current liabilities with its current assets on hand. In this case the change in working capital is computed using the formula above and it is dramatically less.

In accruals system the actual cash that changes hand is different from revenues and. Learn why changes in net working capital NPV should be included in net present value calculations for analyzing a projects return on. NHCZF Change In Working Capital as of today August 18 2022 is 0 Mil.

In depth view into Nihon Chouzai Co Change In Working Capital explanation calculation historical data and more. Free cash flow decreases.

Cash Conversion Cycle Ccc Formula And Excel Calculator

Mid Year Convention Discounting Adjustment And Excel Calculator

Net Operating Profit After Tax Nopat Formula And Excel Calculator

Discounted Cash Flow Create Dcf Valuation Model 7 Steps

Real Estate Pro Forma Calculations Examples And Scenarios Video

Chapte R 10 Determining Cash Flows For Investment

Changes In Net Working Capital All You Need To Know

Capital Budgeting Process Walkthrough And Use Cases Toptal

Discounted Cash Flow Create Dcf Valuation Model 7 Steps

Net Operating Profit After Tax Nopat Formula And Excel Calculator

Free Cash Flow To Equity Spreadsheet

How Is Operating Cash Flow From The Cash Flow Statement Related To Fcf I E Used In Dcf Quora

Chapte R 10 Determining Cash Flows For Investment

Cash Conversion Cycle Ccc Formula And Excel Calculator

Discounted Cash Flow Create Dcf Valuation Model 7 Steps

Adjusted Ebitda And Ev To Equity Value Bridge Divestopia

Capital Budgeting Process Walkthrough And Use Cases Toptal

Capital Expenditure Capex Guide Examples Of Capital Investment

Net Operating Profit After Tax Nopat Formula And Excel Calculator